Establishing who the investors hope to rent an investment property to in advance of the purchase means both parties can have a clear understanding of the next stage of the process once the property has been bought. If both have a community ‘motivator’ they may chose to specify which cohort of tenants they want to support specifically in the co-ownership agreement, or, may pre agree that low income renters more generally are the group they want to support with a home.

These pre decisions will also help co-investors to know which Real Estate agent to link in with for locating a tenant, or whether a social enterprise or not for profit needs to be linked in early in the piece, to ensure tenants are supported to enter, remain and sustain their accommodation.

By buying together, and reducing the cost for each investor, the rent charged for the tenancy can be pre-agreed in the co-ownership agreement to be below the market rent for that suburb or area. If the mortgage is reduced due to two deposits being paid, co-investors can chose to pass on that saving to the tenant, enabling individuals on a very low income to have a stable and secure home.

Mortgage Mates can offer advice, linkages and support to relevant social enterprises and not for profits who can either help in locating the first tenant, or assist in supporting the tenant once they are housed. This means co-investors can be confident in the property being well maintained and the return on investment being met.

Mortgage Mates can also link co-investors in to information on various housing tenures, meaning they can work with third parties to chose whether to rent the property as a single unit or a HMO (house of multiple occupation).

By offering social co-investment via Mortgage Mates we can change the narrative surrounding investment properties. Landlords and investors can still seek financial returns whilst also increasing affordable housing. By pre agreeing exit time frames in the co-ownership document, investors can offer long term tenancy agreements, which not only secure a regular rental payment but also proves security of tenure for the person in the property.

Research shows us that stable housing has a positive impact on an individual due to the reduction in stress from being precariously housed, and due to the prevention of homelessness caused by living in unaffordable properties. Currently 9000 people experience homelessness in WA alone in any one evening, and over 15000 people are on the social housing waitlist.

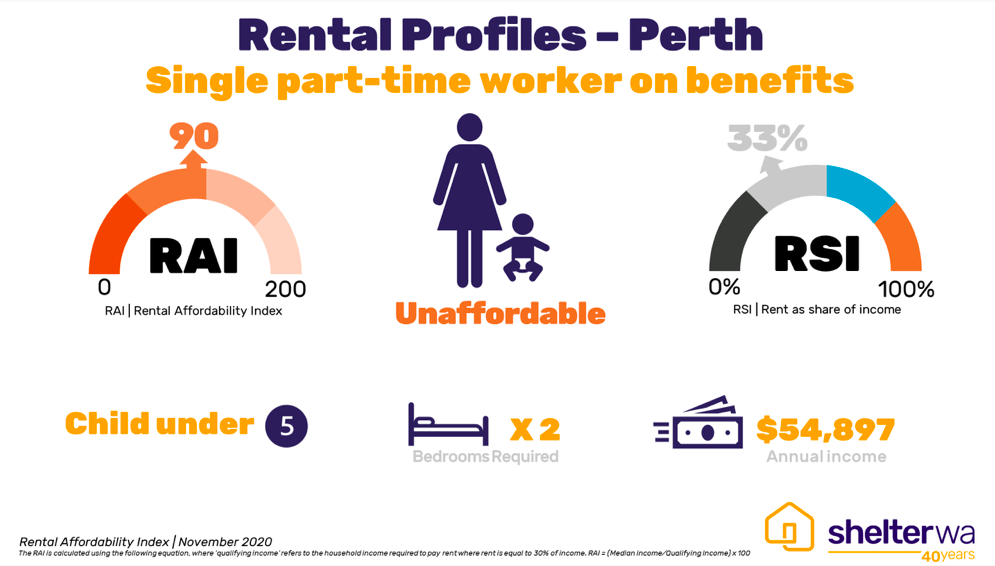

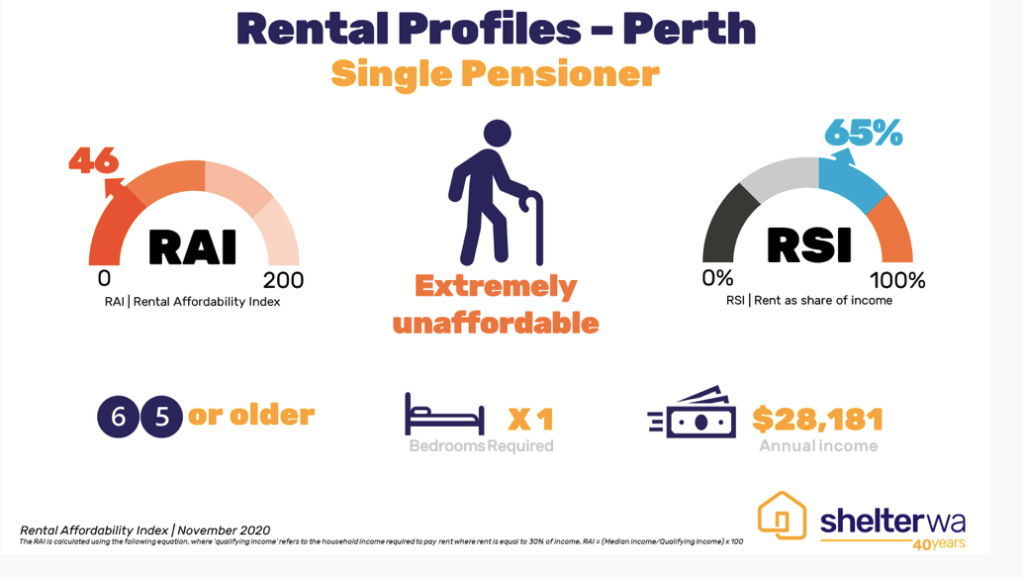

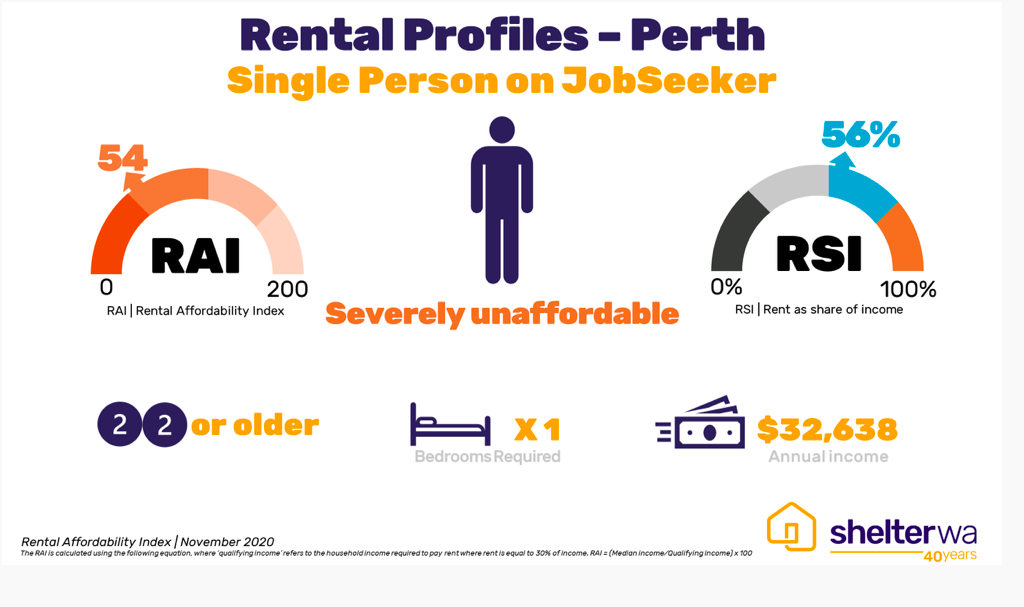

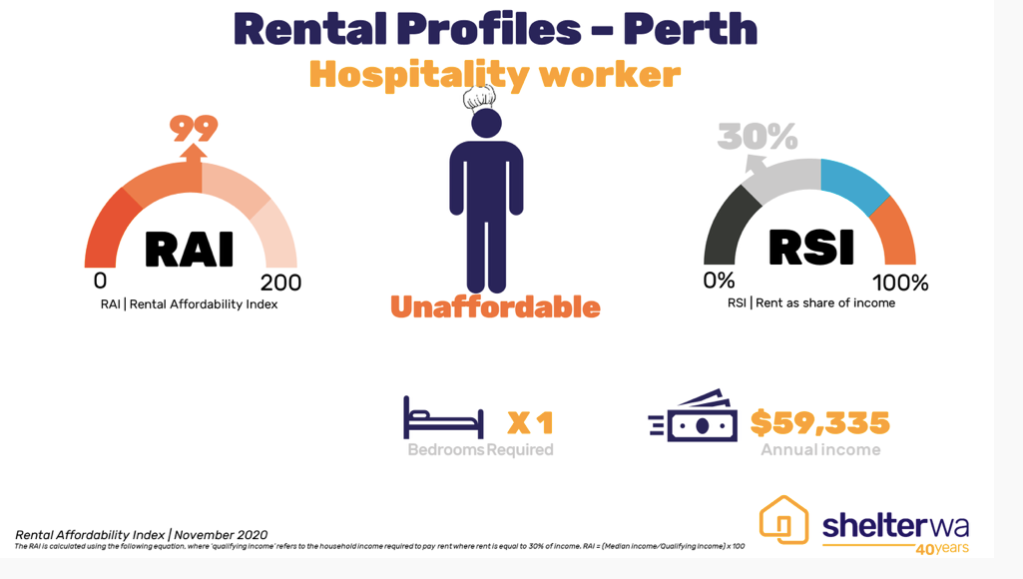

In Western Australia the Rental Affordability Index 2020 was released on 1st December and highlights just how many groups of people are impacted by unaffordable housing.