Coming through a pandemic, it might seem unlikely that now is the right time to be buying a home. But research is showing, that for individuals, the economy and community, now could be the perfect time to buy a home, build more housing and invest in our futures.

For those of us who have remained in employment and are likely to have stable employment moving forward, there are some compelling reasons as to why now, might be the best time to buy.

Firstly, the cost of housing in some major cities is reducing, and whilst the reduction has not been significant, it is still of benefit to individuals looking to take their first steps into the property market. For example, Melbourne, a severely unaffordable market for home ownership, saw a reduction of 0.5 percent in early May.

With reduced housing cost, comes increased housing affordability. Realestate.com.au highlights in this in their piece ‘Five reasons why first-home buyers should buy right now despite COVID-19’. They believe there are five reasons why buying a home during a pandemic, is a good idea, and it seems like first time buyers are listening. The Urban Developer states that during the start of 2020 ‘first home buyers have remained active, edging up to capture a 32 per cent share of the lending market, the highest proportion since November 2009.’

With the risk associated with buying in the current market, investors have all but cancelled their interest in home ownership, at least in the short term. Again, this is substantiated by the Urban Developer who states that ‘investor lending dropped 1.3 per cent during the March quarter compared to the December quarter’ although this is still higher than the same figure last year.

Any decrease in activity in the current market, however small, means that sellers, who may themselves be impacted financially due to the pandemic, may be more open to offers from first time buyers.

Mozo.com.au explains what this actually means for first time buyers… ‘Prices may come down more and with less competition at open inspections, first homebuyers might have a chance to buy into a suburb that a few months ago they may have thought was out of reach,”. This is important, as research conducted by Mortgage Mates, has found that buying in the right location, is often of significant importance for homebuyers.

Interest rates are also at all time lows, which, combined with a lenders demands to fund, may mean there are increased opportunities for first time buyers and lower income earners to seek a good deal. It also means that by entering the property market, the cost of housing may be less than remaining in the rental market.

Realestate.com.au quotes CoreLogic, stating ‘that … more than a third of Australian properties had estimated mortgage repayments less than local weekly rents.’

An additional benefit for first time buyers in the current climate, is that they still have accessibility to government initiatives.

Realestate.com.au states ‘Each state and territory government has its own version of the First Home Owner Grant (and exemptions to stamp duty) which can be found by visiting firsthome.gov.au. On January 1 this year, the Federal government kickstarted its First Home Loan Deposit Scheme, which assists eligible first-home buyers to get onto the property ladder with a deposit as low as 5 per cent. In the wake of coronavirus, the government has extended the 90-day time frame for finding a home to 180 days.’

Choosing to enter the market, not only positively impacts the individuals buying the home, but also helps contribute to an employment market which could help support the economy moving out of Covid-19.

With housing, comes construction, architecture, painting and decorating, interior design, landscaping and many other forms of employment. By increasing affordability, we can increase the number of properties built and completed, and therefor the number of people supported through employment in these varying areas.

AHURI states ‘Investing in housing construction is a key post-pandemic economic strategy to both boost jobs and to provide infrastructure that benefits a great number of Australians. This can include both increasing funding for supply of public and social housing dwellings, and providing shared equity finance for lower to mid income households to buy and build new homes.’

Mozo supports this view point saying “Real Estate is a big rock of economics, so governments use it to stimulate growth as the spin off jobs are so huge,” says Saggers. “Think furniture sales shops, electronics, household goods, electricians, plumbers, roads and infrastructure to new areas. All link to the sale of property.”

In addition to the above the private rental market in some cities is at an all time low for available accommodation- meaning the ability to locate and secure a private rental is even harder than usual. Prospective tenants are competing against multiple other applications and are often require rental payments above market value. Tenants are actually paying their landlords more money for a short term housing option than they would be for a mortgage on their own home.

For those who are currently a step or two away from owning their own home, there are still things that can be done to improve their home ownership journey.

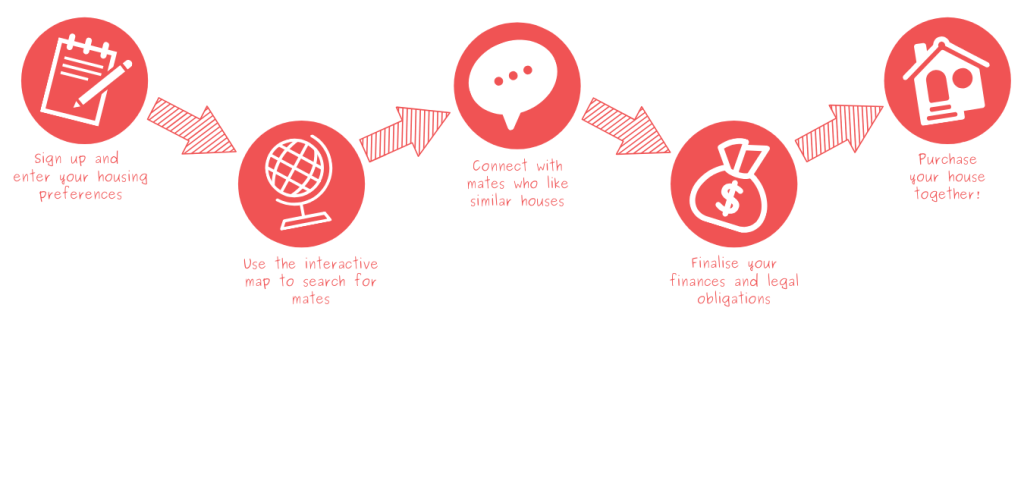

By signing up to a co-ownership website like Mortgage Mates, it is possible for you to sign up to and create a profile which matches you to another individual looking to own a property in the future. By taking these steps now, you can start the process into co-ownership without having to outlay finance in the first instance.

Co-ownership can be a short or long term step into owning a home, but by taking the first step now, it can stop you feeling like the market is moving further away from you- as you are moving forward at the same time.